Unlock the Power of Cryptocurrencies: Understanding Makers and Takers

What are Makers and Takers in Cryptocurrency and How They Impact Your Trading Strategy?

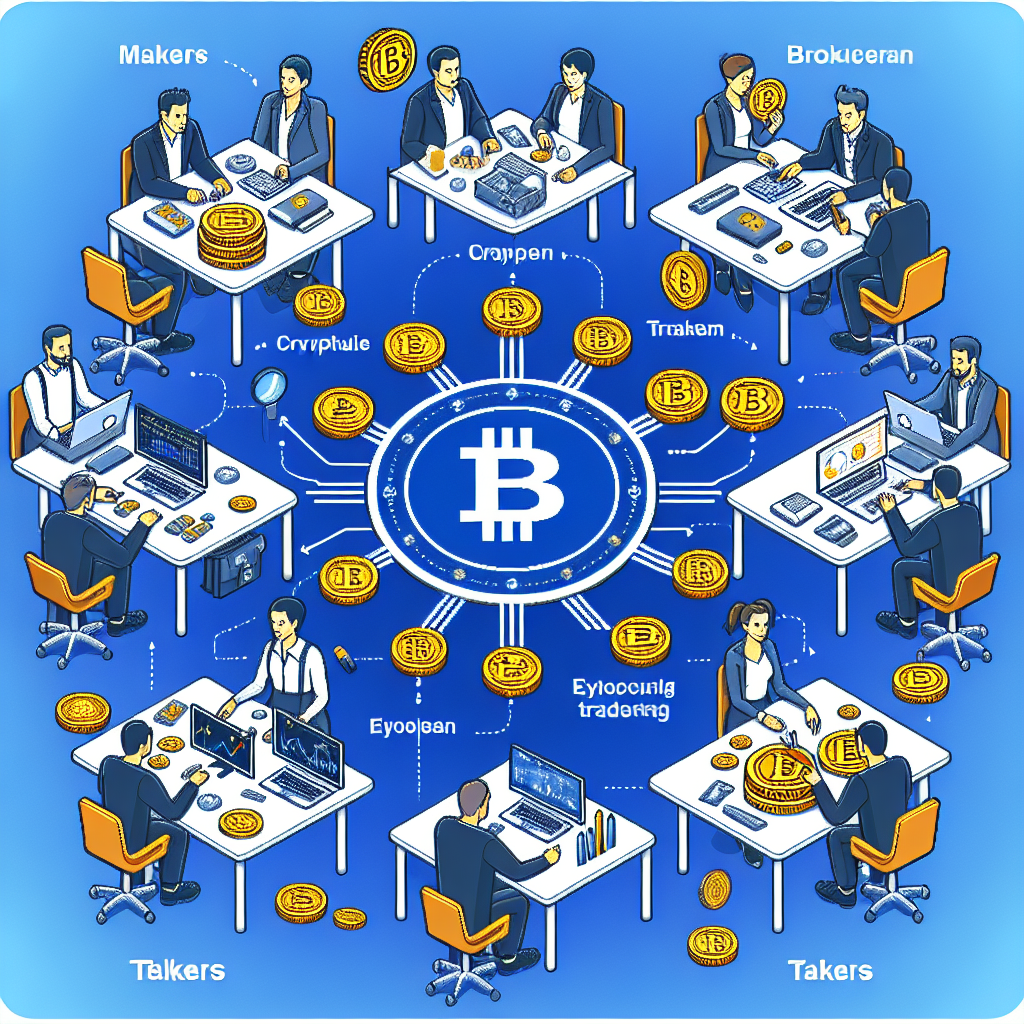

Understanding the concepts of makers and takers in cryptocurrency trading can significantly influence your trading strategy. So, what exactly are these terms, and how do they impact your trading? Lets break it down.

Defining Makers and Takers

Makers are those who place limit orders on the order book. They add liquidity to the market by setting a price at which they are willing to buy or sell, waiting for a buyer or seller to match their order. On the other hand, takers are those who take liquidity away by placing market orders that match existing orders on the order book. They pay the market price for immediate execution.

For example, imagine youre interested in buying Bitcoin. If you place an order to buy Bitcoin at €30,000 and wait for someone to sell it to you, youre acting as a maker. However, if you decide to buy Bitcoin at the current market price of €32,000 because you want it right now, you are acting as a taker.

How They Impact Your Trading Strategy?

Knowing whether youre a maker or a taker can help you save money on trading fees. Typically, makers pay lower fees than takers, making it advantageous to use limit orders whenever possible.

- ⭐ Cost Efficiency: Statistics show that users can save up to 50% on fees by placing limit orders. By being a maker, you can avoid paying higher fees associated with taker trades.

- ⭐ Market Influence: When you act as a maker, youre contributing to price discovery, which can benefit your trading decisions in the long run.

Examples of Maker and Taker Scenarios

Consider two traders, Alice and Bob:

1. Alice, the Maker: She places a limit order to buy Ethereum at €2,000. The order sits on the market, awaiting a seller to meet her price. If her order gets filled, she can potentially get a better price.

2. Bob, the Taker: He places a market order to buy Ethereum at the current price of €2,050. His order is executed immediately, but he pays a higher price compared to Alice.

This distinction could lead traders to consider their strategies carefully. Do you want to pay lower fees and wait for the best price, like Alice? Or do you prefer immediate execution at potentially higher prices, like Bob?

Why You Should Care

Understanding what are makers and takers in cryptocurrency is essential for anyone looking to trade effectively. It affects not just your trading fees, but also your approach to market dynamics.

Statistical data indicates that around 70% of active traders rely on limit orders, making them makers in the market. This highlights the importance of having a solid trading strategy that saves you money while maximizing your investment opportunities.

Ready to Enhance Your Trading Strategy?

If you are looking to refine your trading approach or need assistance with setting up your cryptocurrency trading strategy, the team at Nexrilo is here to help! With 20 years of experience and a full range of IT services, we ensure that your trading endeavors are not only efficient but profitable.

⭐ Contact our knowledgeable customer relations manager, Ecaterina, at [email protected] or visit nexrilo.com to explore how we can support your journey in the cryptocurrency world!

| Service | Cost (EUR) |

| Logo Development | 250 |

| Brandbook I Development | 299 |

| Brandbook III Development | 1170 |

| Website Redesign | 1200 |

| Landing Page Development with Custom Code | 1200 |

| Online Store Development on Wordpress | 5850 |

| SEO Promotion - 20 Keywords | 499 |

| Email Newsletter - Standard | 359 |

| Viber Newsletter - Standard | 359 |

| Google Adwords - Monthly Support | 50 + 10% of budget |

Frequently Asked Questions

- What is a maker? A maker is someone who places limit orders on the order book, adding liquidity to the market.

- What is a taker? A taker is someone who places market orders that match existing orders, removing liquidity from the market.

- How do makers and takers influence fees? Makers generally pay lower trading fees than takers, making their trades more cost-effective.

- Can I switch between being a maker and a taker? Yes, depending on the type of order you choose to place – either limit or market orders.

- Why should I care about being a maker or taker? Your choice affects your trading fees and can impact your overall trading strategy and profitability.

- How can I become a better trader? Understand the market mechanics, including the roles of makers and takers, to devise effective trading strategies.

- What are the advantages of limit orders? Limit orders allow for better pricing and lower fees compared to market orders.

- What are the risks involved with taker trades? Taker trades can result in paying higher transaction fees and potentially executing trades at less favorable prices.

- How do I know if I’m a maker or taker? Analyze your trading history: if you often place limit orders, youre a maker; if you frequently use market orders, youre a taker.

- Can I consult with a professional about trading? Absolutely! The team at Nexrilo can help you with tailored strategies and insights.

Understanding the Role of Makers and Takers in Cryptocurrency Markets: Myths and Realities

The cryptocurrency landscape is often clouded by myths and misconceptions, especially when it comes to makers and takers. Today, lets clear the air and delve into the realities surrounding these two critical roles in trading.

The Common Myths Surrounding Makers and Takers

One widespread myth is that being a maker is inherently better than being a taker. While its true that makers benefit from lower fees, the reality is that both roles serve essential functions in the market.

- ⚡ Myth #1: Makers are Always Profitable - Although makers often pay lower fees, they may have to wait longer for their orders to fill, potentially missing out on price movements.

- ⭐ Myth #2: Takers are Just Unpatient Traders - Takers provide immediate liquidity to the market. Their trades can help maintain momentum and keep markets active, which is crucial for price discovery.

- ⭐ Myth #3: Makers Have Less Impact on the Market - Makers contribute significantly to price stability by placing limit orders that can absorb market volatility.

The Realities of Makers and Takers in Trading

Now, let’s discuss how these roles actually function in the cryptocurrency markets:

1. Liquidity Contribution

Makers add liquidity to the market by placing limit orders, which helps ensure there are enough orders to facilitate trading. This can lead to tighter spreads between buy and sell prices, benefiting all traders.

2. Instant Execution vs. Waiting Game

Takers, on the other hand, will often accept market prices for immediate execution, providing essential liquidity when its needed the most. For many traders, speed is crucial—especially in the volatile world of cryptocurrency.

3. Fee Structures

Many exchanges provide incentives for makers through reduced fees. It’s essential for traders to understand the fee structure of the platform they use. A 2022 report showed that exchanges reporting higher makers volume often highlighted a 30% reduction in trading costs for makers compared to takers.

Your Trading Strategy in the Context of Makers and Takers

Understanding the dynamics of makers and takers allows you to tailor your trading strategy effectively.

- ⭐ Evaluate Your Goals: If you prefer long-term trading, becoming a maker might save you money and get you better prices.

- ⚖️ Balance Risk and Reward: If rapid execution is necessary for your strategy, being a taker may be unavoidable, despite the costs involved.

- ⭐ Stay Informed: Always keep an eye on market trends and adapt your strategies to align with the current state of liquidity and volatility.

Empower Your Trading with Expert Insight!

If youre ready to elevate your trading game, understanding the roles of makers and takers can significantly boost your effectiveness. The team at Nexrilo offers tailored solutions to enhance your trading experience, whether it’s through advanced trading tools or market insights. With our 20 years of experience, we have the expertise you need!

⭐ Call our resourceful customer relations manager, Ecaterina, at [email protected] or head over to nexrilo.com to find out how we can support you in your cryptocurrency trading journey!

Frequently Asked Questions

- What is the primary role of a maker? Makers provide liquidity to the market by placing limit orders, allowing others to trade against them.

- What benefits do takers provide? Takers facilitate immediate transactions and ensure market liquidity, which supports price discovery.

- How can understanding makers and takers help my trading? Knowing these roles can help you identify the best strategies for cost-efficiency and trade execution.

- Are there circumstances when being a taker is necessary? Yes, in highly volatile markets where speed is critical, being a taker ensures immediate execution.

- Do all exchanges have the same fee structures for makers and takers? No, fee structures can vary significantly from one exchange to another.

- What is the advantage of limit orders? Limit orders allow traders to buy or sell at specific prices, potentially saving on costs.

- Can I switch between being a maker and a taker? Yes, you can choose when to use market orders and limit orders based on your trading strategy.

- What are the risks of being a maker? The primary risk is missing out on favorable price changes while waiting for the order to fill.

- How do I know if I should be a maker or taker? Assess your trading objectives, risk tolerance, and market conditions.

- Can I get professional advice on trading strategies? Absolutely! The experts at Nexrilo are ready to help you refine your approach.

Fill out the form below and our team will reach out within one business day